In the race to appear in AI‐generated answers, many marketing and GTM teams naturally focus on the moment prospects are comparing options. But at xfunnel.ai, we wanted to understand the opportunity brands have grab customer mindshare earlier in the buying journey. To find out, we asked over 22,000 "top of funnel" and "middle of funnel" questions across five AI engines—Claude, Google Gemini, Perplexity, and ChatGPT - both to the UI with search, and the API (ChatGPT4o‑latest), to see when and where brands get mentioned.

Why We Conducted This Study

We believed there might be a real opportunity for brands to appear in AI answers before prospects reach the middle-of-funnel stage, when they are already aware of a solution and comparing options. In other words, could top‐of‐funnel content help lock in mindshare before a buyer is actively vetting specific solutions? Our hypothesis was that if you can show up in answers to broader, problem‐focused questions, you'll have a greater chance of making it onto the shortlist later.

Methodology

We asked 2,197 top-of-funnel and 2,413 middle-of-funnel questions, all of which were unbranded. This study builds on our previous analysis of 40,000 AI search responses, where we found that AI search engines like ChatGPT (3.8B monthly visits), Google Gemini (267.7M visits), and Perplexity (99.5M visits) each have distinct patterns in how they cite and surface content.

Sample Top‐of‐Funnel Questions:

- "How do I streamline fragmented employee data?"

- "How do I get more inbound traffic for my website?"

- "How do I keep track of stores that offer cash back?"

Sample Middle‐of‐Funnel Questions:

- "What are the best HR platforms for small businesses?"

- "What is the best website building platform?"

- "What credit card should I consider as a mid‐20s professional?"

We collected 10,985 top‐of‐funnel and 12,065 middle‐of‐funnel responses from the following AI search engines:

- Claude

- Google Gemini

- Perplexity

- ChatGPT4o‐latest (ChatGPT API)

- ChatGPT UI with Search

We then analyzed each response to see which (if any) brands were mentioned, how many brands were listed, and the overlap between top‐of‐funnel and middle‐of‐funnel mentions. Below are our key findings and takeaways. (Note: While you will see ChatGPT4o‐latest in the charts, we'll focus our interpretation on the other four engines as they are what end-users see.)

Findings

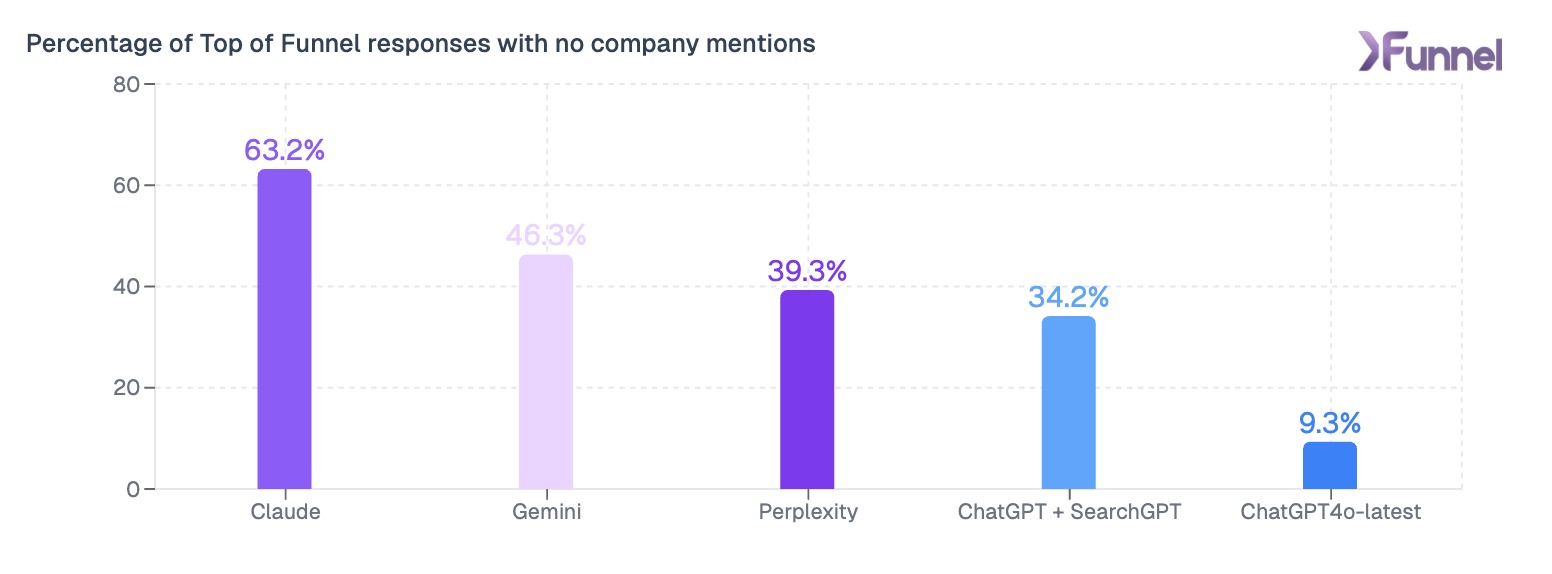

1. Percentage of Top‐of‐Funnel Responses Without Mentioning Brands

Among the four engines (Claude, Gemini, Perplexity, and ChatGPT + Search), 36.8% to 65.8% of top‐of‐funnel answers mentioned at least one brand.

Key Takeaway: There's roughly a 30–65% chance that AI search engines will introduce a brand even when a prospect is in the early, problem‐discovery phase. Being the go‐to resource at this stage can help your brand become "sticky" in the mind of the buyer.

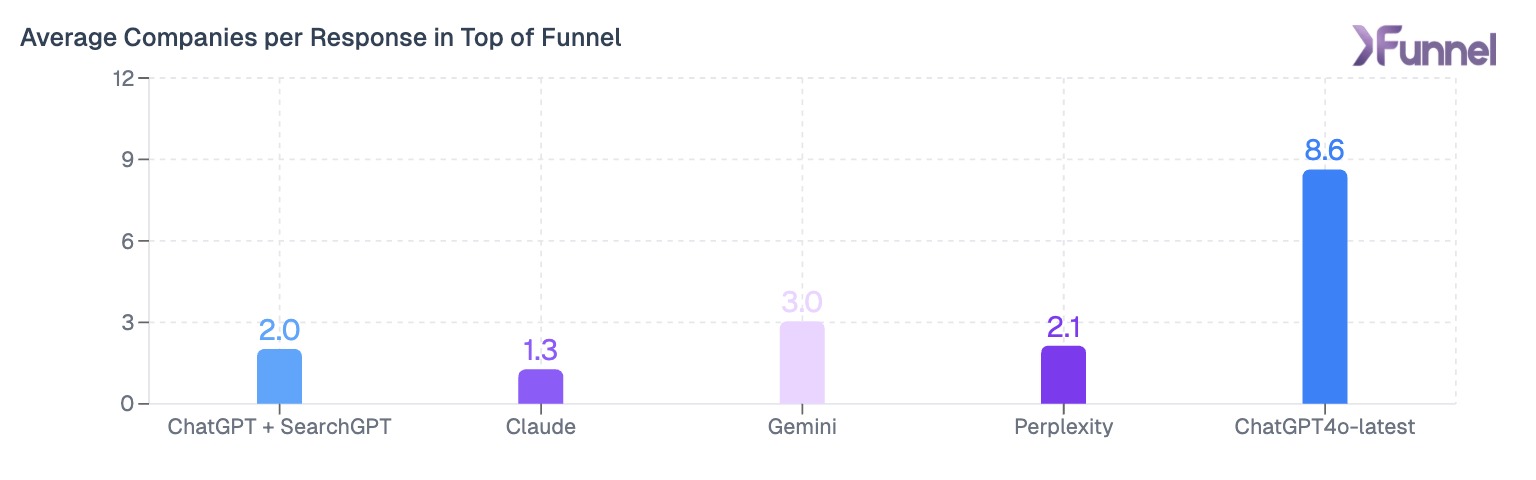

2. Average Companies per Response in Top of Funnel

Ignoring ChatGPT4o‐latest, most top‐of‐funnel answers across Claude, Gemini, Perplexity, and ChatGPT + Search mention about 1.3 to 3.0 brands per response.

Key Takeaway: Top of funnel is less crowded. If you create educational, problem‐solving content, there's more "room" to stand out before prospects are bombarded by competing brand names.

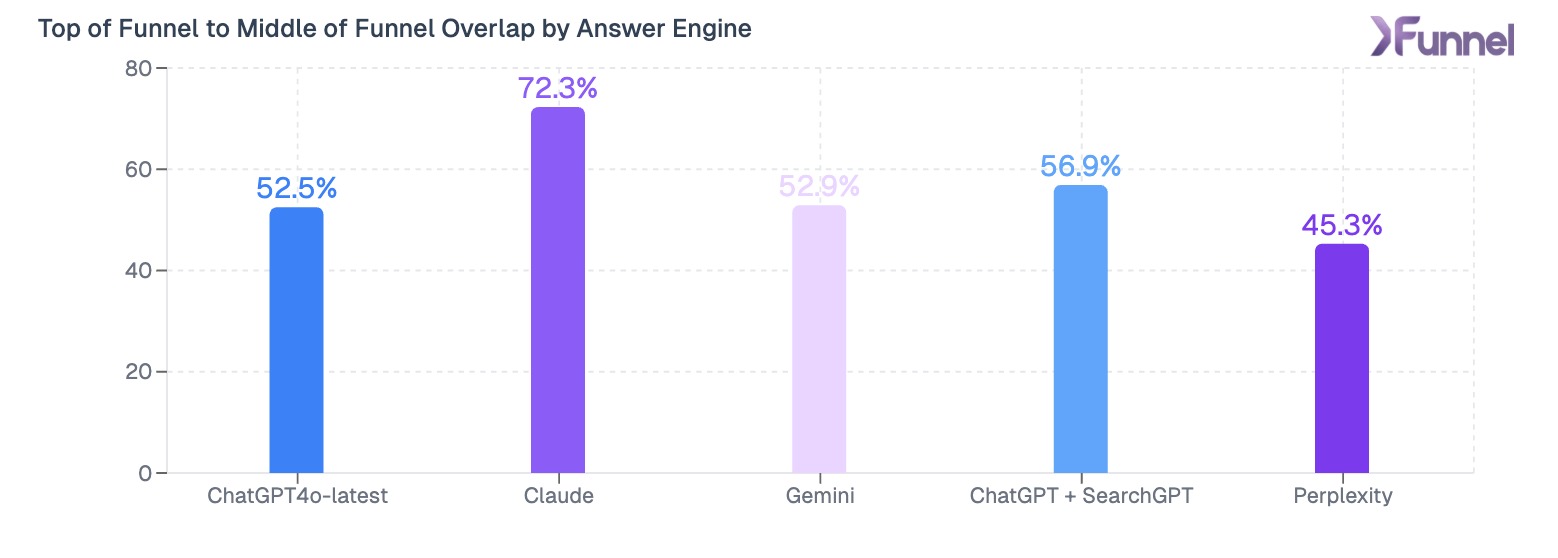

3. Overlap in Brands Mentioned in Top-of-funnel Responses That Appear in Middle-of-funnel

Across Claude, Gemini, Perplexity, and ChatGPT + Search, if a brand was mentioned at the top of the funnel, there was a 45% to 72% chance of that brand reappearing in the middle of the funnel for questions about the same product category.

Key Takeaway: Showing up early in problem‐focused queries can pay off later, as nearly half or more of those brands reappear when buyers reach the "Which product should I choose?" stage.

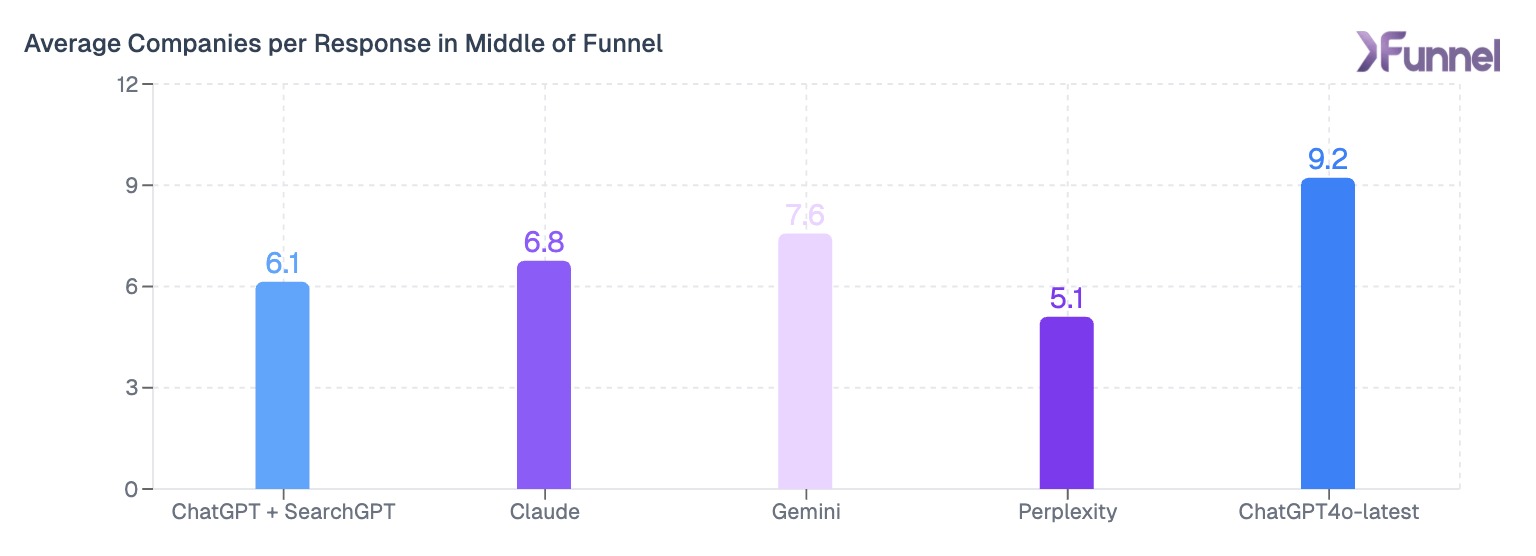

4. Average Brands per Response in Middle of Funnel Responses

By the time buyers get to the middle of the funnel, the average number of brands per answer jumps to 5–7.6 (again excluding ChatGPT4o‐latest).

Key Takeaway: The middle of the funnel is a crowded space. If you can establish brand recognition earlier, you'll have a better chance of not getting lost among the many options that appear at this stage.

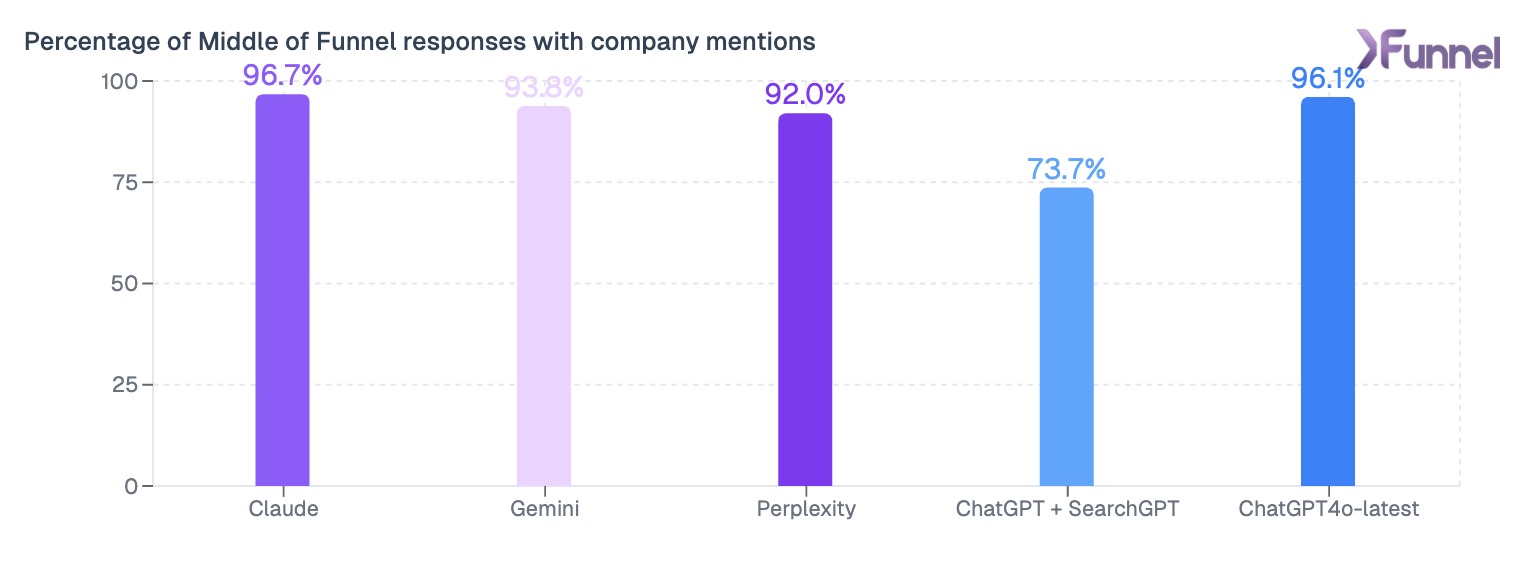

5. Percentage of Middle‐of‐Funnel Responses with Brand Mentions

Once in the middle of the funnel, the percentage of AI answers that include brand names soars, ranging from 73.7% to over 90% on Claude, Gemini, Perplexity, and ChatGPT + Search.

Key Takeaway: By this point, nearly all AI answers mention multiple brands. This is expected as nearly all questions in this phase ask for a solution (although they are unbranded questions). If your brand wasn't introduced earlier, it may be harder to jump ahead of the competition when there are already so many names in front of the buyer.

Conclusion

Our study underscores that top of funnel content can be a meaningful opportunity to gain mindshare. Getting included in these early, problem‐oriented answers can lead to more consistent mentions as users progress through their buying journey, which is also true in traditional SEO. But, we're consistently seeing less competition in top-of-funnel questions. As we move from keywords to questions and conversations, each conversation is unique because each customer type is unique with different problems and needs.. We think the key is to create content that provides value to each of these groups across the buying journey, and ensure it is visible by AI search engines to maximize the chance of maximizing your brands' visibility and conversion.